White Had to be Black

Two Swedish law professors (including the highly respected Lund’s University Professor of Law Per Edwin Wallen) concluded that the standard conditions of SCE’s Deferred Delivery Contracts did not give any obligations for the company to buy or hedge precious metals according to the sales under the contact. Such a decision was entirely up to the management.

Therefore, the Swedish prosecution, already in June 1982, concluded that the companies and I did not have a case to answer, as I, as managing director, acting according to the contracts signed with all the clients.

Bagmandspolitiet did not need such eminent legal opinion and advice and just criminal prosecuted me – they had to, after years in pre-trial detention and 309 days of total solitary confinement.

So the companies did not have any obligation to purchase precious metals when they sold with these business conditions, moreover, no obligation to hedge sales existed. I, as the companies Managing Director, had acted in accordance with the contractual agreement with the customers.

Therefore, the Swedish prosecution already in June 1982 concluded that the companies and I had no case to answer.

Strangely, just across the water from Malmø in Copenhagen, I was prosecuted by Bagmandspolitiet on the basis that I had an obligation according to the same contract to purchase precious metal. To make matters worse, first, the City Court (Lower Court) and later the so-called Appeal Court (High Court), sentenced me according to this failure of not buying precious metals according to the contract entered in to by SCE.

What the Swedish law professors concluded that there was no contractual obligation for SCE to buy, and the company and I acted correctly in accordance to the legal terms which I had originally created – terms agreed upon by Danish and Swedish business lawyers. But white had to be black for the Danish authorities in order to sell the injustices to the Danish public and media. Bagmandspolitiet had to justify all the injustices and it was truly not about the law, but power.

Black has to be White

The claim by Bagmandspolitiet that I had personally recommended investors to buy precious metals and coins at the time was a blatant lie by the Bagmandspolitiet and the media.

I made several interviews with Denmark’s national radio and television (the state monopoly at the time) and I made sure that I answered with regards to buying precious metals by quoting other experts – I did not want to be quoted later on like a bull in the market (expecting the prices to rise). After all, I was personally convinced that the market would crash and had therefore expected to make some real money. My prediction became a certainty after the 18th of January.

All this can be seen from my many Danish Television interviews and newspaper articles that I participated with during the period of 1974 – 1980 (SCE Presse omtale 1976-1979).

I, first and foremost, told investors to buy gold and precious metals for security and as insurance against what could happen in the world, including currency devaluations. I told people to buy precious metals and store them themselves. As to the speculation, that was an entirely different thing. Precious metals should always, in our world, be a part of a portfolio and it is satisfying to see that even LD-Invest and many Danish banks give the same advice to investors more than thirty-five years later.

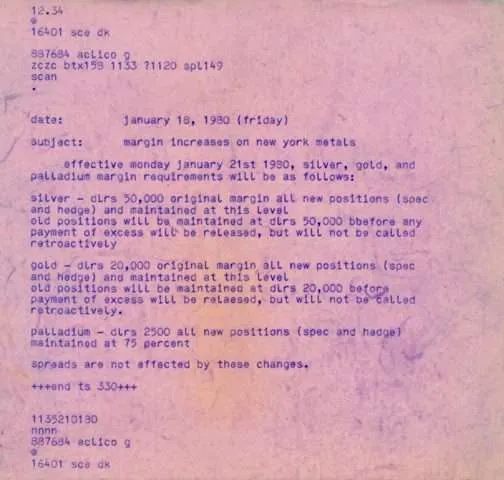

Danish Paper Money 1978 Government Bonds and cash (picture from an SCE brochure)

We did not openly tell the client to buy in the months and weeks before the action by the Danish Authorities, in fact, we had stopped sending out our SCE Marked Report after 5 years of regular monthly publishing.

I did not want to show “in print” that SCE encouraged speculation when the prices were already very high. Our account executives working on commission may have encouraged investors to buy, that is understandable.

The companies did not refuse to take buying orders; we did not have a crystal ball, although I was personally convinced that the market would crash and after mid-January that became a guaranteed certainty.

The fact is that the financial industry has been operating in a way where “you can do everything but just do not get caught” which used to the motto of “The City” of London. Such criteria have been the norm for hundreds of years in investment banking and brokering. It is a matter of size and “reputation”.

Ultimately, it is the aim of all financial institutions to reach a stage where they will never be allowed to fail, as we have recently seen with many banks. At that stage you get into a position like some countries – you can print your own money. That is what happened to the US banks when they recently received billions from the government whilst paying practically no interest and at the same time could have invested this money in government bonds, therefore, earning a high interest.

Like a government can tell the public to buy their bonds and other papers “IOU – I Owe You”, and redeem these “securities” with less money in real term; investment bankers and brokers have always been able to sell the bad investments that they end up with on their books, to their clients.

Nothing is new in the recent indictment against Goldman Sachs when they alleged that they sold securities to their clients which they themselves felt would be worthless soon. Just see the film Margin Call, which for me reflect the real Wall Street and the City of London.

Take the recent report from the Senate Permanent Subcommittee on Investigations. The six hundred and fifty-page indictment reveals the myriad of ways Wall Street lies, cheats, steals and defrauds on a routine basis.

The Senate report, among others, strips two investment banks bare, Deutsche Bank and Goldman Sachs. The report accuses them of packaging and selling toxic securities while, at the same time, betting that those securities would fail.

Furthermore, the report argues forcefully that “Investment banks were the driving force behind the structured finance products that provided a steady stream of funding for lenders originating high risk, poor quality loans and that magnified risk throughout the U.S. financial system. The investment banks that engineered, sold, traded, and profited from mortgage-related structured finance products were a major cause of the financial crisis.”

It’s obvious that the US Senate subcommittee is gunning for Goldman Sachs. This elite investment house, the envy of all Wall Street, is shown to be corrupt to its core. Not only is it accused of creating toxic assets and unloading them on its own customers, but also, the report accuses GS of betting that the very assets they were selling would fail.

They profited by selling the junk and then profited, even more, when the junk they were selling lost value. The deeper the financial destruction, the more they made. And of course, they didn’t tell the buyers of the toxic assets about GS’s hidden bets or the fact that their internal research showed that the assets were totally toxic.

In 1970th until late 1979 we only used telex machines and telephones to get information and therefore had to rely on the people at the other end, to tell the truth – most of the time they did, but not when it concerned their own money and certainly not when the markets moved fast or were in a panic. We had to manual daily prepare our own charts, ranging from bar charts to point+figure charts, momentum with an oscillator. All manual drawn requiring so much time. Now, this is all done in nanoseconds.

Today it is an even playing field with information at the fingertips, lots of information and from different markets.

Nothing is new as to how Wall Street works, Wall Street is more powerful than any country and many of “their people” work at the top of the U.S. government.

John F. Kennedy’s father sold all of his shares just prior to the 1929 Wall Street Crash after telling his clients to buy these shares and pumping the media with positive disinformation about the companies he had invested in. That was the right thing to do then and now. But now it is more of an even playing field for investors with the Internet and general legal transparency. Nevertheless, this does not prevent the US hedge fund managers from speaking out to CNN and CNBC with regards to a certain default of Greece, after they have all gone short in the market.

Again – Lies, damned lies and Bagmandspolitiet

When Bagmandspolitiet was making out to the Danish public that I and my companies were “criminal” by using lawyers offices for companies registered in the respective countries and not employing any staff. That this was “criminal” somewhat showed the political attitude at the time, something which still prevails among many Danes.

Well, near 40 years later, more than 1600 billion Danish Kroner has left the country to offshore and 55 countries.

It is a well-known fact that so many offshore companies and indeed US, Dutch, Irish and even the UK holding companies do not employ any staff and as Bagmandspolitiet claims are just “post-boxes” with no real activity behind them.

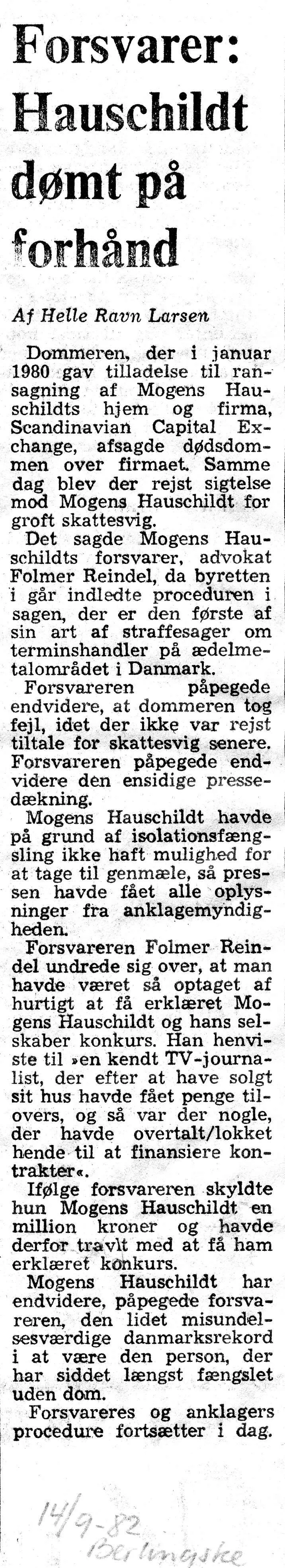

“The Danish National Bank, the Ministry of Trade, the Company Register and Copenhagen tax authorities all conspired against Hauschildt and the companies whilst using the involvement of the Ministry of Justice, the Special Prosecution and the court as henchmen”

– Advocate Folmer Reindel to the City Court in 1982 and later in 1988 in front of the full Court of Human Rights with 17 Judges from 17 member countries

Companies like Google and Microsoft use companies in Holland, Bermuda and indeed many other places without anyone employed, all just registered at a law office. This has according to Sunday Times (2011) saved Google alone in the last 5 years more than US$5 billion in taxation, all legal. I know of several substantial Scandinavian companies which for many decades has used “post-box” companies to save billions in local taxes. In fact, these companies could not survive international without taking full advantage of offshore entities.

In fact, these companies could not survive internationally without taking full advantage of offshore entities. As I had stated other place, one must really respect companies which operate out of Scandinavia if their businesses allow them to move abroad. Take Apple as a typical example, the last year paid less than 10% tax on their US$ 34-35 billion income (see: How Apple Sidesteps Billions in Taxes)

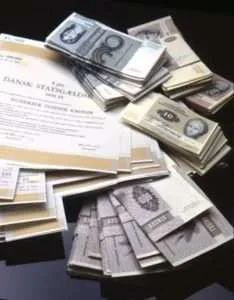

Precious metal bars on my desk in 1975 – today worth millions

The banking sector has the largest number of tax haven companies in 2011. In the United Kingdom the big four banks – HSBC, Royal Bank of Scotland, Barclays and Lloyds – having a total of 1,649 offshore subsidiaries – all just post-boxes. They have the largest number of companies registered in the Cayman Islands, with Barclays alone registering 174 subsidiaries and ventures there. HSBC has 156 subsidiaries in Delaware in the US, which has limited reporting requirements, compared to 97 in the rest of the USA. Lloyds Group has 97 companies in the Channel Islands. As of writing, I see that even the British prime minister’s father had his money offshore, perfectly legal (Cameron family fortune made in tax havens )

In creating this criminal image of me and my companies using offshore entities, there was no difference in the way the Danish political and fiscal authorities acted against me and my companies and how the east European communist totalitarian regimes and Sovjetunion acted at the time, no different.

All the Manufactured Lies – Also about the Companies

All the headlines and accusation from the Special Prosecution that I was running away from Denmark at the time of my arrest, was a total lie. Apart from the fact that I during the weeks before had made many trips abroad including to my offices in Holland and Sweden, my wife and I spend weekends in Switzerland.

What is more relevant I was in negotiation to buy a property on Sankt Annæ Plads for our new head office for the companies the days I was arrested. In addition to this, the company planned a media campaign in March 1980 with new expensive brochures which we had already invested several hundred thousand Danish kroner in. I had been in Stockholm just ten days before my arrest to finalise setting up a new office there for our Swedish company, as we had for many years office in Malmø.

What is more relevant I was in negotiation to buy a property on Sankt Annæ Plads for our new head office for the companies the days I was arrested. In addition to this, the company planned a media campaign in March 1980 with new expensive brochures which we had already invested several hundred thousand Danish kroner in. I had been in Stockholm just ten days before my arrest to finalise setting up a new office there for our Swedish company, as we had for many years office in Malmø.

The companies were finalising an agreement with IBM to complete computerised operations; the work for this had been going on for some six months before the events. So we had many commitments for the companies and many were in hand and needed my full attention in the days ahead.

Due to the steeps fall in the silver price and precious metal prices after the 18th of January, SCE planned to issue a margin call on the 1st of February for an amount exceeding D.Kr 10 million. This meant that clients had to either pay additional money to the company within 7 days or liquidate their contracts. Bagmandspolitiet knew all this from their wiretapping of our telephones and also the above facts that I was buying the above property for a new head office in Sankt Annæ Plads.

Trust – a Valued Commodity

Trust and integrity are the most precious and valuable commodities when you are involved with other people’s money, they are so fragile and rarely able to be restored if you lose them.

Planting the seed of doubt about anyone dealing with other people’s money can ultimately lead to terrible consequences.

As said before, “Of all the ills there are, Rumour is the swiftest. She thrives on moments and gathers strength as she goes”

The financial market is based upon trust and the integrity of the people. I used to say that if we are standing in Trafalgar Square together with hundreds of thousands of people and the loudspeaker says, “Lynda, the women in the red dress standing there is a prostitute”, what can Lynda do? Nothing, she can’t get up on the stage and explain that she is not a prostitute. Everyone will ignore any comment from her – that is trust and it is so fragile.

The moment that all of Denmark could turn on the TV and see their only Danish television news at 19.30 on the 31st January 1980 and see with their own eyes that bagmandspolitiet closed Scandinavian Capital Exchange, all trust disappeared.

There was no trust, respect or confidence left neither to me, the staff, the company nor its agreements. Agreements that all the clients had entered in to buy their own free will.

Bagmandspolitiet knew that what they did for the open television screen would seal the case completely. They knew the first day that they had created a miscarriage of justice “justitsmord” and thereafter they just had to cover it up and be creative whilst using the willing Danish media.

It went so far that members of Bagmandspolitiet wrote an essay about a person and events which closely followed some part of what happened. In this essay, the main character was a criminal and was very guilty of fraud and other misdemeanours that he had planned. The essay was published in a book that was sold all over Scandinavia.

Such a miscarriage of justice was nothing for Bagmandspolitiet because this is the way they worked. Never mind the hundreds of clients losses; they should be “taught a lesson”. With regards to me, I was thrown into solitary confinement for ten months to rot – hopefully coming out like a total quashed human being.

That first day the Bagmandspolitiet and the Danish authorities killed a human being, me, and left a rotting corpse (justitslig). Everything they did thereafter was just to cover up this corpse from injustices, the killing and everything which really took place. This was very simple as they used (misused) their power by fabricating lies and deceit whilst using the willing Danish gutter-press to spread the lies.

Advocate Folmer Reindel told the European Court of Human Rights in Strasbourg – 26th September 1988:

“It is clear that the Danish authorities had, for a long time, the objective to close down Hauschildt’s successful and profitable business, irrespective that the companies acted correctly and within the Danish law.

From the first day of the action against Hauschildt and his companies, it has been the objective of the Danish authorities to justify their illegal acts at any cost, including keeping Hauschildt in solitary confinement and pre-trial detention for more than four years as a hostage to justice.

The Danish authorities acted within total contempt for the Danish law and justice and the European Human Rights Convention.

Hauschildt and his companies became victims of the Danish State”

Interestingly, in the few weeks following my arrest, some clients of the companies complained (after reading the malicious lies in the press and being telephoned by Bagmandspolitiet) that they had received a “bad” repayment price of their liquidated contract in the weeks leading up to the closure of SCE. Even Børsen mentioned this in a large article in May 1980.

Since I have not been able to answer this before, I will now. The fluctuation of the silver price in the few months before SCE closing and specifically in January 1980 was very frantic and volatile and could move around by up to 30% or more within 24 hours. Moreover, the markets closed for a period during the trading day (see: Telex to SCE 24 January 1980 re closing markets)

According to a newspaper article in ( Financial-Times_17_January_1980 )Johnson Matthey, the largest bullion dealer in London quoted £12 per troy ounce when the market price was trading at £20 per ounce. The company refer to a very volatile market, so did we at SCE and we have never had such a large discount, possibly 10-15% – that was all.

For many investors who took profit one day and then saw that they could have waited until the next day or a few days later and have made an even greater profit, is always a sour grape for any company. Investors taking profit in such situations always have some excuse telling of how they could have made more and that they were badly advised to sell. As far as I am concerned, a profit is a profit when it is received.

The Rise and Fall of the Silver Price

Because I knew that the silver price would crash sooner or later, in fact, guaranteed to fall after the action by the management of the commodity exchanges on the 18th January 1980, I transferred close to US$2 million to London in the week before my arrest. This payment did not come from Denmark but from my company M. Hauschildt et Cie in Zurich, Switzerland. I wanted to sell up to forty contracts of silver (see They Stole a Fortune from Me ) at around the US$35-40 per troy ounce, as I rightly predicted the market to fall dramatically because the floor brokers on COMEX and in Chicago were all short.

This last fact became clear to me for the first time in September 1979. I had invited a director from Mocatta and Goldsmith (a leading bullion dealer), in London to sail with me over a weekend in Denmark. The director had to cancel his trip with a few hours’ notices since his firm was confronted with a grave situation.

20 one kilogram of silver bars in my office 1974 valued at less than D.kr. 10,000 whereas today (2011) the value exceeds D.kr.120,000

The following week I became aware that Mocatta had been short, in a big way, in silver and was caught out by the Hunt Brothers and their Saudi friends who wanted delivery of silver and controlled the “longs” in the market.

Nevertheless, Mocatta was able to borrow ten times their capital to cover this huge loss of buying silver for delivery.

When a company can borrow ten times its value, some special guarantees must have been given to the lenders, moreover their confidence in the head of the company.

The head of Mocatta, Dr Henry G. Jarecki was the president of COMEX, the most important commodity exchange in the world (together with the Chicago Board of Trade). Since Mocatta had to pay back their substantial loan, it was obvious that the professionals and the floor traders had to win over the “longs” from the Hunt Brothers and the Saudis sooner or later.

One should not sit down and play a game with the people who control the game and who always have the power to change the rules to their advantage.

On the 18th of January 1980, it becomes a guarantee that the silver price was going to collapse completely together with other precious metals. In fact, it became a certainty, not a question of speculation, as many newspapers later reported, including Børsen in Denmark.

The action on the 18th January by New York Commodity Exchange (Comex) was followed by the Chicago Board of Trade on Tuesday the 22nd January. They also enacted severe restrictions on silver futures, effectively closing the U.S. market in silver futures. As reported by New York Times and International Herald Tribune “The Comex directors, afraid that there would not be enough silver around in March to satisfy customer demand, announced also Tuesday that “until further notice” no new futures contract in silver could be bought or sold on the Exchange. Traders will be limited to “liquidating” their current position.”

An article in the International Herald Tribune’s article (IHT 23rd January 1980 ) dated the 23rd January said: “Analysts said that the Comex move could spell the eventual death of much of the futures trading in metals in the United States, especially since Chicago found itself forced to move in the same direction as New York. Furthermore, the move – if prolonged – could spell the death of the Comex, which is the world’s largest metal exchange.”

Practically all my enthusiasm as to know all this and that the market would crash, led me no doubt speak on the telephone expressing what I knew was going to happen with the precious metal prices and how the companies would benefit from this. Considering these calls was listen to by Bagmandspolitiet and their wiretapping, no doubt this influenced their timing as they did not want me and the companies benefitting from all this.

Just prior to Christmas I took profit in all the precious metal contracts which I was long, considering the market. Most professional view the market as somewhat overheated and expected a technical reaction downwards.

Even the highly respected Green’s advised everyone to sell. They even predicted what I also was convinced of, that Comex would sooner or later make a ruling as to all the short position in the market, something which happened on the 17th January nearly a month later. In fact, quoting from Green’s (Greens Commodity Market Report 19 December 1979) as to their view on silver:

”The previously heralded squeeze in December did not materialize, but we are convinced that those short February delivery in Chicago and the March delivery on Comex will have great difficulty to extricate themselves from their positions. Probably the only salvation for the shorts lies in some kind of ruling by the Board of Governors of both exchanges forcing liquidation at a fixed price. (The Comex by-laws provide for such eventuality.)”

Now when most of these Governors are professional floor traders – all short thousands of contracts, they will first and foremost protect themselves, everyone knows the market should know that and no one should go long in the market with such a situation. Therefore, I did not buy silver from that time onward since it would, in my opinion, be stupid.

OK, Afghanistan came over Christmas with the invasion by the Russians, but I still accessed the market on the short side, although it was difficult seeing the prices moving against me until the 17th of January.

So from Friday the 18th January 1980, my professional conviction and assessment of the fall in the price of precious metal became a guarantee for a crash, a crash where our companies and I was going to make a lot of money.

Since the prices of precious metal would for sure fall in the coming weeks, I did express myself to a few people (on the telephone, with Bagmandspolitiet listening in) that I could see the price of silver at US$10 within weeks. I also expressed that the company should continue to take orders on the long side since the newspapers and many journalists were “still advocating to buy and that the prices would rise”. The fact that these people did not know about how the markets work, was not for me or my employees to point out, after all, we wanted to make money, so we took orders from many clients.

It is a Great Feeling to be Right – if Nothing Else

One of the great things about the world of finance is that it freely offers the sensation of being proved right to its participants. Every transaction in the market has a buyer and seller; in most cases one of them is right and the other is wrong because prices either go up or they go down. The cumulative weight of this right or wrongness is one of the things that make the whole scenario very interesting.

After the event in Denmark, I had to become a “Bagmand” a man behind the scene when financial business was involved. I could not be up-front in any financial company since “there is no smoke without fire” and what happened in Denmark was something people could read about on the Internet in the last 20 years. As I have detailed other places on this website one have to declare everything when serving in public companies and to financial regulators. There is also the question of trust and integrity – all gone out of the window with the events in Denmark.

I did consider back in 1988 to establish a satellite television business channel for Scandinavia on the lines of CNBC which had just been launched. I could see the possibility to advance the integration of the various Scandinavian stock markets.

In this connection, I had meetings with among others the famous Robert Maxwell who I had to tell what happened to me in Denmark. After listening he told me, you can never get the last word in the media, also when the media have painted a picture of you – this picture will never get out of people mind, you can’t wash it away. Then he told me, “I realised after the Pergamon Press affair (a company he ones owned) that the only way to deal with the press is to own the press, so I bought the largest newspapers in this country.” On another note, I do not believe that Robert Maxwell death was an accident. He was a criminal stealing all the pensions’ funds, but this was not known at the time.

We kick-started what became Saxo Bank

One person’s risk (or ignorance) is another’s opportunity and gain. The difference between the two often comes down to the eye, or perhaps more accurately the sentiment of the beholder. Already in the late sixties, I believed that the Scandinavian investors lacked sophistication and knowledge as to international investing. This was a result of the local capital restriction for so many years and the countries isolation from the international financial market. Therefore, to me, Scandinavia offered great potential with regards to financial services and banking one day.

Timing in business is everything, considering what happened to Scandinavian Capital Exchange, we were far too early. The American has a saying about pioneers “That they are the people with arrows in their back”. I bitterly felt that in my own back. However, sooner or later the time would be right when the capital markets ultimately would open up in Scandinavia and investors would become more aware of the opportunities to invest in the global market. More importantly, become more experienced and accepted to speculate and take risks on the financial markets.

Due to the injustices done to me, I was never able to take advantage of the opportunities in the Scandinavian financial market; however, the opportunity and timing transpired when my son Hans Christian and I helped my son Mark Anthony and Lars Seier Christensen with the seed money to set-up Midas (today Saxo Bank) in September 1992. Folmer Reindel, my defence attorney served as director of the company for many years and later my other defence attorney John Korsø-Jensen served as Vice-Chairman on the board of Saxo Bank.

Considering that I was unable to take advantage of the great potential with regards to banking and financial services in Scandinavia and the rest of the world, at least something was created by the family’s money left from the terrible injustices in Denmark. I am pleased to see the great success of Saxo Bank, with their leading-edge technology and financial expertise.

The Booms and Busts has Always Been Here

Economic crises – unsustainable booms followed by calamitous busts – have always been with us and will always remain. Every crisis is an opportunity. There will always be speculation; I spend some time surveying the many booms, bubbles, and busts starting with the speculative bubble in tulips in 1630s Holland, the South Sea Bubble of 1720, the first global financial crisis in 1825 and the Panic of 1907.

At the time of writing, we are in the midst of a great financial crisis, which brings great opportunity. I do not believe in paper-money – it is always a matter of the printing press without obligations, I can think of a world where gold will be trading at $5,000 or even $10,000 per troy ounce. I hope not because this will not be a “nice” world, at least not if this price range will be reached in this decade.

The US Dollar is a Reserve Currency and it is still easy for the US to “sell” their money to the rest of the world, but one day – as the saying goes, “you can fool people some of the time but not all the time”.

The reality of the printing press of money and debts one day will ultimately be clear. Most nations like the US have been borrowing money into its existence every year. The debt increase and the conventional ignorance of monetary history have made most nations enslavements to banks. I believe that sound money will always win, therefore always own gold and silver.

The Rigged Danish Justice System

Yes, the Danish justice system was rigged before my win and judgement against Denmark at the European Court of Human Rights in 1989.

Yes, it was rigged by political prosecutions like mine. Yes, it was rigged because the Ministry of Justice was in charge of the police, prosecution, the appointment of the judges, the courts and prisons.

Even the former Minister of Justice for seven years and longest-serving member of the Danish Parliament, Erik Ninn-Hansen confirmed that the judges in Denmark were not independent – but under the dictatorship of the Ministry - he should know!

Rigged definition in most dictionaries: - manipulated or controlled by deceptive or dishonest means

Rigged is defined as something that is fixed in a dishonest way to guarantee the desired outcome.