Taxation – The Big Issue

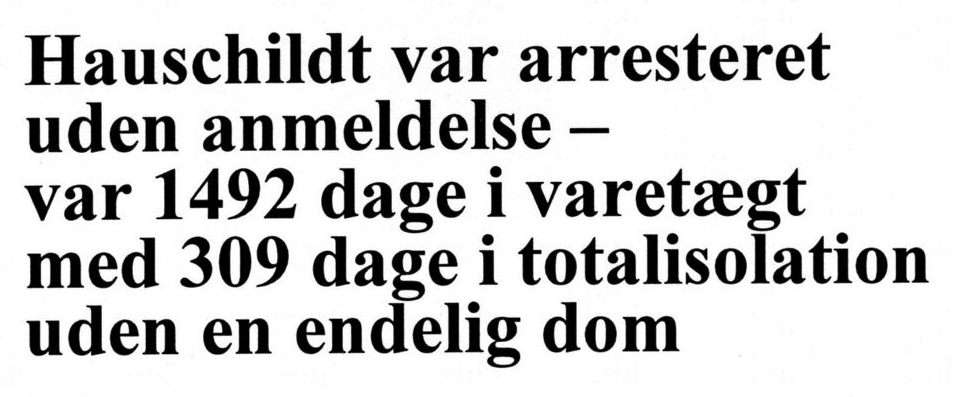

Taxation was a primary issue and motive for the authorities, however only a secondary issue in my personal case, since they knew that no tax evasion had been committed by me personally. Nevertheless, they had to use this alleged fiscal claim against me in order to get the arrest and search warrant to carry out the whole action on the 31st January 1980.

4 days after my arrest the newspaper headlines report that the Danish fiscal authorities NOW got involved in a fraud case? – Stupid newspaper and press, the fiscal authorities started it all started it!

4 days after my arrest the newspaper headlines report that the Danish fiscal authorities NOW got involved in a fraud case? – Stupid newspaper and press, the fiscal authorities started it all started it!

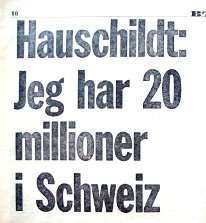

Although I never did see the details as to the warrant for my arrest, some details came out later during the trial, where my defence found that a loan I had received from my company in Switzerland, M. Hauschildt et Cie back in 1976 for Swiss Fr.450,000 was considered as income by the Danish fiscal authorities, after more than 3 years and having accepted all my tax returns.

Firstly, I was not subject to Danish tax before I purchased a property in Denmark in 1976; secondly, the fiscal authorities had approved my tax returns for 1978 and the previous years. None of my advisers such as accountants and auditors knew anything about the tax allegations. My 1979 tax return was not due for filling at the time of my arrest.

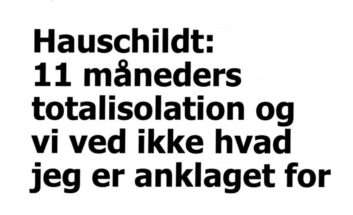

A loan giving to me 4 years before and indeed prior to me and my family moving to Denmark was used for the warrant for my arrest and closing of the companies? Frankly, neither the defence nor I know the details of this warrant. I never saw it, but it goes to show the trumped-up charge used by the Danish authorities to close the companies and lock me up in solitary confinement for open television screens.

The Danish authorities had hunted the companies and me for close to five years before and they had tried everything including harassing me and the management of the companies on a daily basis, however, they were never able to do much with regards to the law, since we did nothing wrong or illegal. In fact, this was also the conclusion of Christen Amby, the deputy chief in charge of the Copenhagen Tax Department in an internal memorandum to the Danish National Bank in October 1979. (see also: The Red Tax Troll)

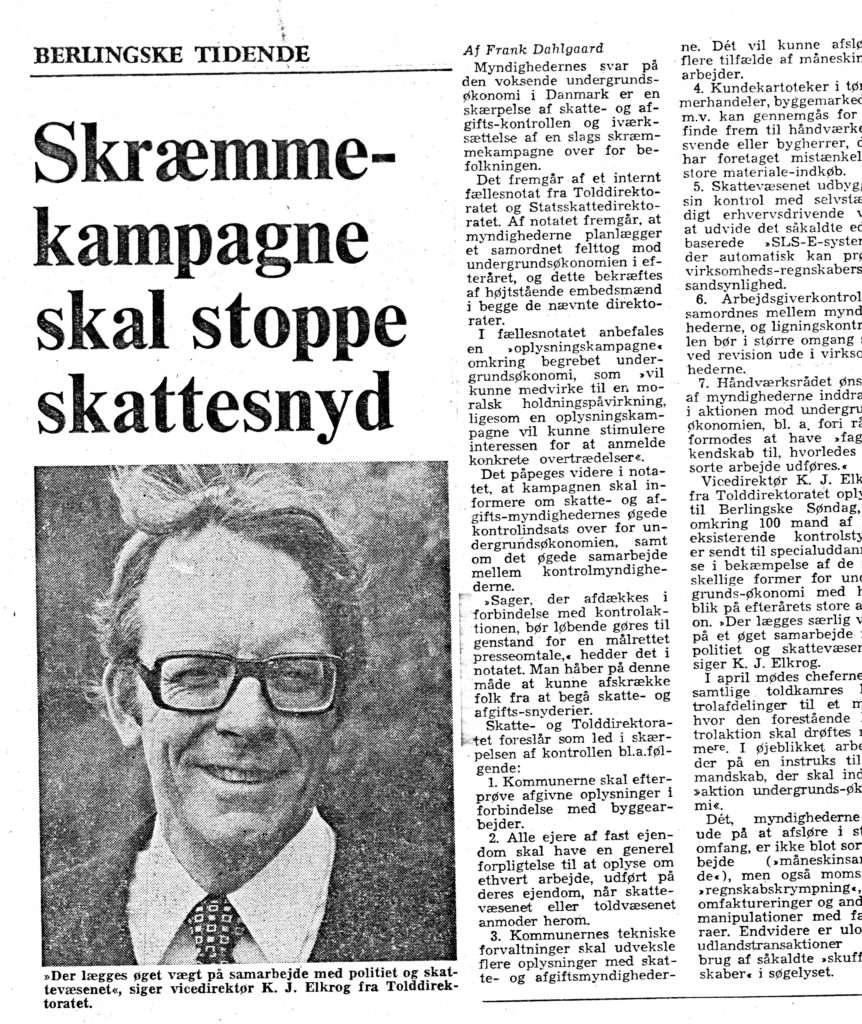

Fear campaign to stop tax cheats

The fiscal authorities created a fear campaign to stop “tax cheats” putting real fear into people

Even prior to starting SCE in Denmark, I had several meetings with senior people in the Ministry of Trade and the National Bank, in order to make sure that everything we did was legally correct and was within the law and within the various restrictions that Denmark imposed on our business.

During the years 1974 – 1978, the company sold platinum, palladium and silver bars over the counter, in addition to bullion coins (gold coins like the Kruger Rand).

The company advocated investors to diversify their investment, so they invested 10-15% of their money in the precious metal as insurance against inflation and stock markets crash. Moreover, it was important for these investors to delivery of their precious metals and coins – as insurance against any major upheaval.

Thousands of investors took our advice and purchased (through the years 1974 – 1980), gold, platinum, palladium and silver in bars and took delivery themselves. Also, many investors purchased gold coins for cash over the counter, which the company had advocated for years. Investors who did buy at the time had to wait many years, but today they can look back on investment with good profits of up to 600 – 1200%. I hope that the many investors who took our advice enjoy their profits today.

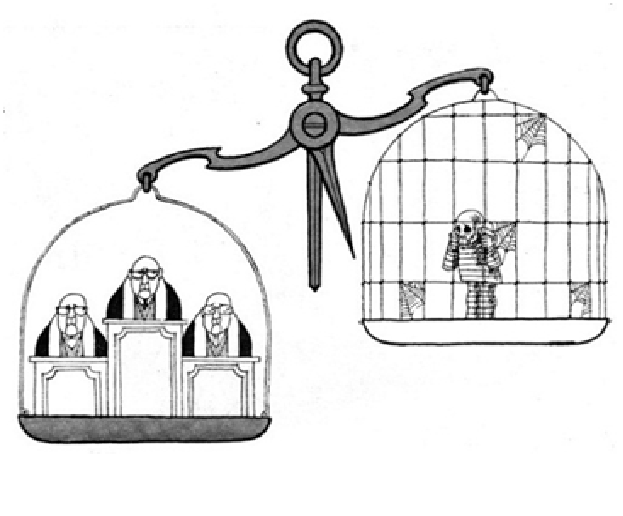

“The Danish National Bank, the Ministry of Trade, the Company Register and Copenhagen tax authorities all conspired against Hauschildt and the companies whilst using the involvement of the Ministry of Justice, the Special Prosecution, the tabloid media and courts as henchmen” – Advocate Folmer Reindel to the City Court

The Danish revenue was concerned for years as to investors using so-called “black money” and unregistered cash. Such activity would be reluctantly accepted if it was only relatively small amounts; however, in view of the substantial investments in 1979/80, this became a larger “problem” as such. In addition to this, since there was no precedence or effective rule, certain conditions were not evident. Because the EU considered precious metals and coins as goods and in Denmark, goods were subject to sales tax (MOMS), it was not a requirement by Danish law that clients had to show any documentation or be registered when buying precious metal “over the counter”. Therefore, the fiscal authorities had no record of these people’s names.

The companies were subject to many visits by the Copenhagen Tax office, including by the deputy chief of this office, Christen Amby.

They regularly harassed the companies and tried to “blackmail” the companies (and me) to inform on clients and people who purchased metals and coins over the counter – and then just took them home.

The Customs and Excise Office was responsible for the value-added tax on goods. When SCE was a small company, the Customs and Excise Office agreed to permit that the sales tax/value-added tax (MOMS) could be refunded when the customers sold their goods and contract.

With regards to the deferred deliveries of the goods where most clients did not want delivery, and thereby in most cases – no import; therefore purchase tax on import was not possible. No doubt, these matters did concern the Customs and Excise Office; they saw the amounts growing larger into millions of Kroner.

During the years that the companies operated (1974 – 1980), Denmark had currency restriction and therefore Danish investors could not invest or take part in the speculation on the stock and commodity exchanges in London, New York and Chicago.

“The Danes have started to go back to gold” The newspaper informs it, readers, that collections of gold coins and diamonds are not subject to taxation on profit.

The last fact was changed retrospective by law! Not a proper democratic state worthy.

SCE introduced, for the first time to Danish and Scandinavian investors, the opportunity to buy precious metals, gold, silver, platinum and palladium, indeed another form for real assets including precious stones. Since I had expected the Danish currency restriction to be lifted, at least some years after Denmark’s membership in the EU, allowing Danish investors to invest and speculate on the overseas stock and commodity exchanges, I somewhat became concerned in 1978 when Denmark still did not allow a Dane to take more than D.Kr .5,000 abroad. Moreover, despite the EEC (EU) membership, Danes were still very restricted in what they could do with regards to investment abroad. The restriction was even worse in Sweden and Norway.

That taxation was an issue; it became obvious from the various statements made to the media on the 31st January by the heads of Bagmandspolitiet, including Finn Meilby and Mogens Kanding.

Moreover, all the Danish newspapers front page headings the day after the raid and the arrest, related to the fiscal background for the case: Børsen, Friday the 1st February 1980

Front page headlines: The Special Prosecution closes Scandinavian Capital Exchange – Making charges for serious tax evasion against Denmark’s largest bullion dealer – Heading: Precious metal dealer accused of tax evasion Police close Scandinavian Capital Exchange Scandinavian Capital Exchange has been closed by Bagmandspolitiet. “Through channels which we control we have found out that possible serious tax evasion has taken place, according to the criminal code paragraph 289 tells Mogens Kanding Børsen”.

We will go through all the material and especially concentrate on the companies order confirmations and dealings with its clients since we wish to double control on these client’s tax returns. At the same time, we want to concentrate to see if there has been any wrongdoing by the company, as an example if we suspect any fraud against the clients, we will contact these clients and ask for their version”

In reading the whole article, the reader must get the impression that the Special Prosecution was on a “fishing expedition” and that serious tax evasion must have been committed and that the fiscal authorities wanted to see investors’ tax returns and that the only way to do it was by closing the companies and later making out that I was responsible for the investors’ losses.

It is important to note the fact that Kanding tells the newspaper that Bagmandspolitiet would contact the companies’ clients and ask for their version – of what? This being done after the closing of the companies giving some of these client losses – what should the client say?

Cardinal Richelieu understood the value of surveillance when he famously said:

“If one would give me six lines written by the hand of the most honest man, I would find something in them to have him hanged.”

Jyllands-Posten, Friday the 1st February 1980

Criminal commissioner Mogens Kanding Bagmandspolitiet tells Jyllands-Posten:

“We have been investigating the company since it started (1974) just to see what is happening. Approximately three weeks ago our investigation became more intensive on our own initiative. We have not received any complaints”.

Jyllands-Posten: Is there only a question of tax evasion? Yes, at this time Jyllands-Posten: How big amount is in question? This we can’t inform you about. Bagmandspolitiet has been investigating the company for more than five years just to see what? Just like Stasi or KGB. As Stalin said, “Show me a person and I will always find a reason against him” (to kill him or send him to the Gulag). In the companies, we knew that the Danish authorities had been harassing us constantly for years, but we did not know that Bagmandspolitiet was involved, see: Five years of continuous harassments before the event.

No complaint had been made to the police and the Special Prosecution. The fact that they later claimed that the Copenhagen fiscal authorities had asked a judge for a warrant for my arrest for tax evasion – is another matter Nevertheless, according to the newspaper and what they were told Bagmandspolitiet decided themselves to take the action. Further, that black money is invested in precious metals and the profits are tax-free outside the reach of the fiscal authorities.

I was never charged with tax evasion since this was a trumped-up charge and there truly was no tax evasion by me or the companies.

We were blackmailed regularly by the Copenhagen Tax Authorities (Københavns Skattevæsen), who wanted access to the names of our clients and their transactions. On one occasion in 1979, they demanded that we pay tax there and then on all future income despite losses in the previous year (we had handed over D.Kr. 200,000; otherwise the tax inspector would not leave our premises).

We had staff that had close relatives working in the National Bank and we even employed a retired senior police officer to supervise the transport of our precious metals. I employed these people, and I at least expected them to report back to their relatives and families that we did nothing wrong or against the law and that we only operated according to all the rules set out by the government and the National Bank. Making matters worse, we were regularly prevented by the National Bank from being able to hedge our currency and commodity transactions, creating considerable losses for the companies and at times, leaving business transaction too risky to enter into. Because of the considerable volatility in the currency rates, this represented sometimes a much bigger risk than the purchase/sale of precious metals.

The National Bank put pressure on our banking relationship and in one case, created a huge loss for us with Andelsbanken, one of the banks we used. None of these facts was ever reported in the Danish media.

We were subjected to wiretapping (recording of telephone conversations) by the Danish authorities long before my arrest in January. Bagmandspolitiet knew from this wiretapping that all of our Deferred Delivery Contracts in silver and platinum had a minimum of a three-month possible delivery clause; a strong legal agreement with our clients who had agreed to enter into when buying on margin. This, together with the fact that I was absolutely certain that the precious metal price would crash due to the action by the Commodity Exchanges in New York and Chicago, must have aggravated the Danish authorities whilst listening to my telephone conversation.

The Special Prosecution also knew that the company would be calling some of the clients to make “margin calls” amounting to close to ten million Kroner.

The Danish public and many clients of Scandinavian Capital Exchange was fooled and lied to by Bagmandspolitiet and the Danish media. Fooled by the misinformation, malicious lies and innuendoes put out by the prosecution in the press.

Advocat Folmer Reindel

Bagmandspolitiet took maximum advantage of spreading allegations according to some clients’ who were so disgusted with the prosecution’s method; unfortunately, these clients’ voices hardly showed up in the media.

The Companies Created Considerable Press Coverage Through the Years

During the period 1974-1980, The Companies collected many headlines and press coverage mostly in the financial media. SCE’s mission was to educate the Scandinavian investor since they had been isolated from the international world of finance. SCE pioneered many forms of investments including investing in precious metals (gold, platinum, palladium, rhodium and silver). SCE regular Market report was often quoted by the financial press and the subject of many articles in the press.

Therefore, the company instigated a considerable amount of info-media coverage, held regular seminars and published material aimed to educate the investor.

This activity was a central part of the companies operation and really a pre-requisite to developing a proper clientele and market activity (SCE Presse omtale 1976-1979).

Scandinavian investors had little choice as to investing; the governments wanted them to buy financial instruments created by the banks, so they could “control” all data and information. Investors were directly encouraged to invest in bonds which did not even give them a return but paid out a little wining via a lottery. Very cheap money for the governments at the time.

In Denmark, the so-called mortgage bonds also were encouraged since the coupon was easy to tax. The currency restriction did not allow investors to buy foreign currency. This left investors totally unprotected against possible devaluations and other upheavals from outside. The only way to protect against such risk was to buy real assets such as precious metals.

SCE first and foremost encourage investors to buy some precious metal and “keep it close” e.g. in their home or if they had a bank box, this as insurance against a “rainy day” more or less like you pay an insurance premium against the future. When investors did this they most of the time paid with cash and received their precious metal bars or coins over the counter, not providing their names and address. It was not required at the time for the companies to register such purchases apart from charging purchase tax.