Scandinavian Capital Exchange

The Company started in 1974 as an Anpartselskab (ApS); I purchased this already registered company and changed the name to SCE ApS in 1974 because the authorities would not permit the name ‘Scandinavian Capital Exchange’ at the time – it was far too official. I knew we could still trade as SCE, Scandinavian Capital Exchange, and shortly later I incorporated successful Scandinavian Capital Exchange AB in Sweden and Scandinavian Capital Exchange AS in Norway without any difficulty, since we operated with the full name.

Christiansborg, the seat of the Danish Parliament, could be seen through the doors of our reception at the banking premises at Højbro Plads in the centre of Copenhagen. Our world-famous author Hans Christian Andersen had lived in the building, more than a hundred years earlier.

The initial purpose of the company was to make a base, for a financial service company, in Scandinavia and to take advantage of Denmark becoming a member of the EEC (EU) as well as the expected opening of the capital markets in Scandinavia. Opening up the capital market and ultimately change in capital restriction and exchange movements, would offer considerable potential for an investment bank. Unfortunately, this did not happen for a long time, in fact much longer than I originally had expected.

The company operated initially as a bullion dealer and commodity trader with the aim to ultimately become an investment banker some years in the future. Bullion dealing had been the foundation of the oldest banks and the Merchant banks in Genova and Venice, such as Rothschild and Johnson Matthew, in the City of London for centuries. I hoped that SCE would develop in their direction and ultimately become a fully-fledged investment bank when the Scandinavian capital market would ultimately open up, which I did expect some time in the early 1980s.

I was too optimistic as to this, it took many years, for the Scandinavian financial market to open up, worse I was naive as to the political power and general socialistic attitude. Further, the power of the “old” financial institutions, to fight back and hold on to their political protection, basically “stealing” money from the Scandinavian investors.

When we provided the seed capital for my son Mark Anthony and Lars Seier Christensen to start what ultimately become Saxo Bank, many years had gone by and ultimately when Saxo Bank become really successful, it was more than 30 years after I first plotted my journey and my first plans for such financial service company.

Preamble

At the impressionable age of fourteen, I was fortunate to work for a few hours after school for “an old fashion banker” Eiler I. Baastrup. I say work, in fact, most of the time I was sitting listening to him telling me about his life, about the Danish government’s conspiracy and deceit with the German occupation in 1940 of Denmark. Telling me about Danish politician, the hypocrisy and the lies in general and all about money. He advocated that Greenland should remain Danish and foresaw that it could contribute great wealth to Denmark one day. He wrote two books, one about Greenland and another with Harald Tandrup.

Eiler Baastrup had many theories as to money, from what I learned than; paper money had only the value that people placed in the confidence of the country – the issuer. Eiler Baastrup was an interesting person who had for many years been married to the daughter of the head of the Danish National Bank. He claimed that he gave the Danish politician the idea to exchange money after the Second World War ( in July 1945) only months after the end of the War. His idea was stolen by H. C. Hansen, later a Prime Minister. This exchange of banknotes was most successful for the authorities since it made it difficult for all the people with “black money” generated during the German occupation.

Later on, in the sixties I started reading about paper money and government bonds and that these I.O.U. (I owe you) never had been redeemed by any government with more value, always less, even that all government and politician conspired to borrow cheaply from the public and never paid back the real value of the money they constantly borrowed.

When I started collecting old bond and share certificates and banknotes (Scripophily) in the early 1960s, I also realised how little value and trust one should place in a country as to the paper they issued.

Paper versus Real Assets

I become convinced for the need of investors to diversify their investment portfolio in addition to holding equities and bonds. The fact that the world populations were growing and resources limited made commodities and precious metals an attractive investment.

Having worked with Swiss banks for several years, I witnessed that they always recommended that 10% of an investment portfolio went into gold, despite the fixed gold price at the time. Gold was considered insurance against any upheaval, wars and financial calamity.

In the late 1960s, I started advocating investment in gold prior to President Nixon decision on the 15th August 1971 to leave the gold standard. Many investors benefitted from this move, although it had been very difficult for me to sell them the idea of investing in gold in the first place. Some even made tens of millions, where I only made a small fee.

I also become actively involved with technical analysis and after 1968 met regularly with a group of like-minded people working in the City of London. At the time technical analysis was scorn upon by many fundamental analysts and investment managers. Years later, in the late 1980s, we incorporated ourselves into a non-profit company and I designed the logo of STA, which is still in use. Later, I was even asked to head the Society of Technical Analysts (STA), however, due to the event in Denmark, I could not consider such a role. The STA is today a highly respected London City institution with 1200 members from all the leading banks and financial institutions.

Quoting from STA website: “The Society of Technical Analysts (STA) is recognised worldwide as one of the largest and most widely respected not-for-profit organisations which trains and accredits members of the investment community, from industry professionals to private individuals, interested in the study of technical analysis. We have been setting the standards in technical analysis for 50 years and have been teaching at several UK universities such as LSE, King’s College, Queen Mary etc. for 25 years.”

In 1967, I established an investment market research company together with a few partners, the company (Intervestment Research, later Capital International) published an investment analysis of 1600 largest companies worldwide (in United States, Canada, Europe, Australia and the Far East) and gave regular advice as to institutional investors. Truly a venture ahead of its time, as only one stockbroker in the UK had an investment research department. Most of our analysis of the 1600 selected companies worldwide was based on fundamentals, but slowly we introduced the technical analysis of share price and the companies’ financial data.

In addition to this company, I formed the first financial and estate planning company, for high net worth individuals, in the United Kingdom in 1968, Associated Financial Planning Limited (AFP). I did this together with the Duke of St. Albans, the Marquess of Reading, James Talbot and Euan Inchball. Talbot was in charge of F&C Foreign and Colonial Investment Trust, one of the oldest and largest investment trust in the UK at the time. Michael, the Marquess of Reading, held the highest title in the British peerage ever attained by a Jew.

Unfortunately due to various issues including the economic crisis, with the bear market in 1969-72 and the loss of large contracts from various investment groups, moreover, possibly, my own faults we had to sell part of the company and liquidate.

We had a closed-end investment trust in Luxembourg ScanInvest, since I was one of the first people to be involved with holding companies incorporated in Luxembourg, already in 1966 with Intervestor S.A.

The monthly investment research report later was taken over by Chase Manhattan Bank and become ultimately part of the Morgan Stanley World Index.

Before we sold the research company I had gained experience with the stock market and that everything as to dealing in equities and indeed everything else in the financial markets was a matter of “inside” knowledge.

If I was not convinced that this was the case, jumping a little, in the week prior to the October Crash of 1987, I sad in the Knickerbocker Club in New York having lunch with a friend, an internationally known economist, who I worked with (Woody Brock). Next to us, according to him, as I only recognised two of the people (David Rockefeller), the other was A.W (Tom) Clausen, two of them were the heads of the largest two US banks. One of the bankers, who I once met (did possibly not recognise me) said quietly to the other banker: “all this talk about insider trading, did you ever buy anything without “Knowledge”? “Of course not that would be stupid, “ said the other.

My point, I realise every early that all financial markets were manipulated first by the issuers of securities and secondly by the trade itself, the stockbrokers, the bankers and all the “insiders” including people who hold shares. All the lawyers, accountants and indeed also the rating agencies only speak for their own interest. Governments around the world also manipulate the issues of their bonds and the printing of their paper money – ALL THE TIME.

Today’s financial markets are a more even playing field with the Internet and more transparency.

Most Investors Has a Short Memory

My first real experience as to the manipulations of stocks was the Australian mining boom in the late sixties where I witnessed an increasingly frenetic activity.

It all started in 1965/66 with the first stirrings of one of the most remarkable speculative booms of all time, the Australian Nickel Boom. The main company Western Mining, later Great Boulder and the Poseidon came along. Despite our company was not involved directly in the stock markets, I could not fail to see every morning the news on Reuters from the Australian stock market close. Since I took my children to school in the morning and came to the office shortly before 8.00 in the morning, whereas my partners first arrived around 10 or later, I had ample opportunity to read these wire services – all coming down a telex machine.

For several years I had been investing in share which came to the London market, new issues on the recommendation of one of my partner who had been a stockbroker for twenty years. These new issues always increased in value of their first days of trading and it was easy picking, however, I had no knowledge as to Australian shares so it took me some time to get involved, in fact, a few years.

During 1968 and 1969 I saw the shares of Poseidon go from a few Shillings (20 Shilling on one Pound Sterling) to £120, a new company Tasminex came along. This company issued shares at a few shillings in November 1969 based on a clutch of leases near Mount Venn North West of Windarra in Australia, the centre for the nickel boom. As with all these mining companies nearly all the shares were held by directors and “friends” mostly institutions, therefore making an obviously thin and highly volatile market in response to any real volume of buying and selling.

After a run-up of Tasminex in one day from £3 to over £40, on reports in early January 1970 that it had struck massive nickel sulphides while putting down an exploratory borehole to look for water for its drilling crews, I started making some calculation which convinced me that the stock market price was totally unrealistic.

Thereafter, I gave first order to sell 10,000 shares at a fixed price and later everything in the market since it was impossible to get a fixed price, the shares just kept on falling, making me a little money on the way, as I covered my sales in the fall – possibly too early, but a profit is a profit.

According to the market history later, my selling orders influence the change of market sentiment in London and the start of a dramatic crash in Tasminex shares but also other Australian mining stocks

As with many of these mining stocks it turned out to be manipulated fraud, nevertheless, I promised myself that next time there appears to be a boom and investment bubble, I will get on the plane and take full advantage of the situation – I never did despite the many opportunities around the world since.

Investment Bubbles

In the mid-sixties, I started reading works by John Stuart Mill (his book from 1848). He was the first to recognise bubbles; Mill believed that bubbles begin when some external chock or accident – a new market, for example – set “speculation at work.” As prices rise, the sight of others growing rich “call(s) forth numerous imitators, and speculation not only goes much beyond what is justified by the original grounds for expecting rise of price but extends itself to articles in which there never was any such ground: these, however, rise like the rest as soon as speculation sets in” By time, I become more convinced that if markets are fundamental self-regulating and their collective wisdom is always right, then the prices of assets brought and sold in the market are accurate and justified – that this was really wrong!!

Louis Bachelier, the French mathematician, whose Théorie de la spéculation, argued that an asset’s price accurately reflects all known information about it. There is no such thing, in his view, as an undervalued or overvalued asset; the market is a perfect reflection of the underlying fundamentals.

As a market technician, using technical analysis I always argued that everything is reflected in the price – somewhat a distorted standpoint which I after the publication of Manias, Panics, and Crashes by the economist Charles P. Kindleberger become convinced about as human beings are an irrational lot, prone to fits of economic exuberance and euphoria.

These views made me take the stand in late 1979 that the bubble in precious metal was a real bubble at the time and had nothing to do with fundamentals, even after the Russian invasion in Afghanistan.

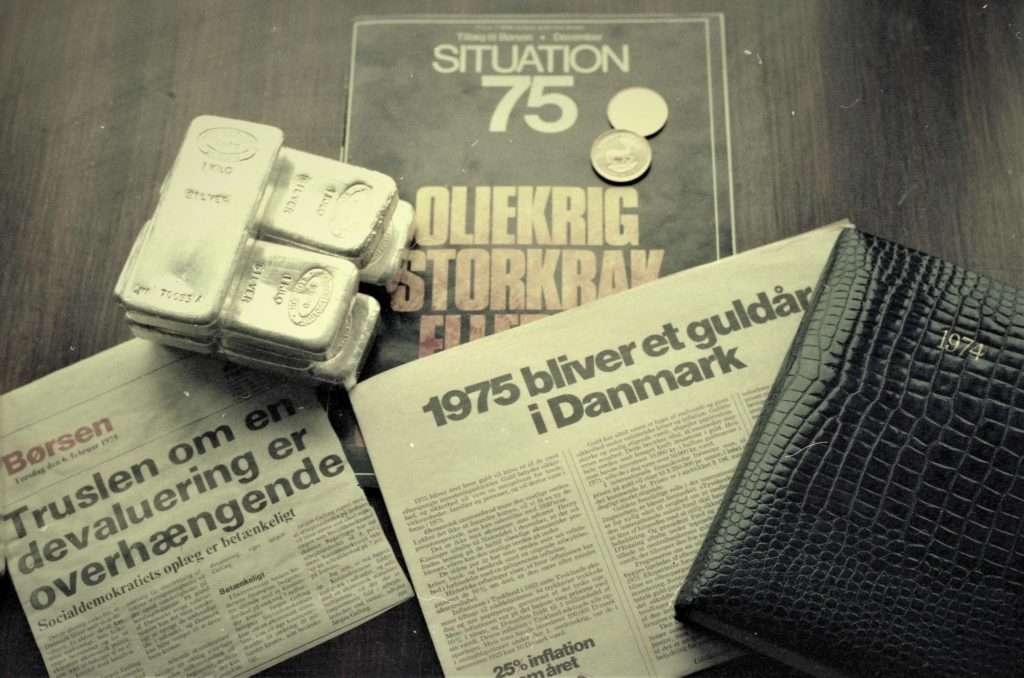

In addition to setting up Scandinavian Capital Exchange in Denmark, I started ScanCapital in 1975, a closed-end investment trust which solely invested in commodities, specifically copper, zinc, lead and aluminium in addition to precious metal gold, silver and the platinum metals such as rhodium and palladium. In addition, the company had plans to invest in the so-called strategic metals (Cobalt, Titanium, Zirconium, Chromium and Manganese) as soon as the markets become more transparent and organised. It was hard work to persuade investors to make such investment in commodities.

I pioneered such investment more than 40 years ago but was stopped in my track by the Danish authorities with my life destroyed and my business reputation in ruin.

The Group of Companies

During the years 1973 – 1980, I established several companies all for different purposes and objectives. Some of the companies were established with a fiscal view in mind and others from the necessity of operating in a local market.

In addition to the companies below, I established the Hauschildt Foundation in Liechtenstein (1973) and UniCapital Anstalt also in Liechtenstein, which the family used for trading in securities, currencies and commodities. The following companies were in operation at the time of my arrest and solitary confinement:

M. Hauschildt et Cie Zurich (1973)

An unlimited partnership in Zurich operating as a bullion dealer with the objective to get a full Swiss banking licence within ten years. This was the company I expected most from in the future, operating as a private bank in Switzerland. Bryan Jeeves and I were the unlimited partners. Bryan Jeeves was a respected British Honorary Consul in Liechtenstein and specialised in corporate fiscal matters, foundations and trusteeship. Due to my arrest, long pre-trial incarceration and the event in Scandinavia, Bryan Jeeves went on to form his own group of companies the Jeeves Group with offices all over the world.

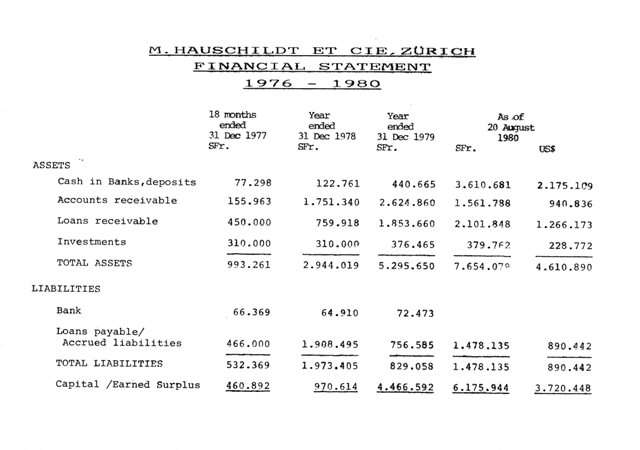

M.Hauschildt et Cie had net assets in excess of SFr. 6,000,000 at the time of my arrest (see They Stole a Fortune From Me). The financial statement below shows the period 1976-1980.

Capital Associates AG Chur (1974)

A Swiss investment holding company which held all the shares in the companies and the group including SCE ApS, Scandinavian Capital Exchange A/S (under incorporation), Capital Associates Limited, London, Investment Exchange B.V., Rotterdam, Scandinavian Capital Exchange AB, Sweden, Scandinavian Capital Exchange, Norway and International Resources B.V. Holland.

Capital Associates Limited London

(1978) The company was established to start operation in London as a broker/dealer in commodities, foreign exchange and derivatives. (£300,000 paid-up capital). At the time of my arrest, various people took advantage of the events in Denmark and simply stole the company, partly, with the assistance of Bagmandspolitiet’s passivity. I had applied for membership of the new exchange LIFE (London International Financial Exchange and been accepted, just before my arrest. The Special Prosecution (Bagmandspolitiet) prevented the payment for my membership. The initial £20,000 membership was later traded for over a million Pound Sterling and the exchange was very successful.

SCE Aps Copenhagen (1974)

The sale of precious metals in bars and coins on margin and with physical delivery over the counter to investors.

The company represented various highly respected companies like Spink & Sons (London) in Scandinavia. Spink was the oldest established coin dealer in the world founded in the City of London in 1666.

SCE traded in gold coins and precious metal bars (platinum, palladium and silver). It was not allowed to sell gold bars to the public, even I argued that gold bars were “goods” and subject to purchase tax. The Danish authorities argued it was capital, despite that gold was subject to purchase tax and according to the EU rules, should be considered as normal goods.

Initially, we wanted to educate the Scandinavian investors as to the investment world, therefore, we publish regularly a market report and newsletter. In addition, we held regular seminars around in Scandinavia. We worked together with others, such as Børsen and held special seminars for companies, where we were teaching them how to hedge their sale or purchases in the forward market. SCE published many brochures and information material including: “Hvorfor skifte fra papir” and “Sadan investerer man“.

SCE supplied several newspapers with daily prices on precious metals, including Børsen and Børsinformationen operated by Klaus Riskjær

Scandinavian Capital Exchange A/S

(Kept under incorporation by the Danish authorities and after 6 months and not registered): The objective of this company was to become an investment bank and follow the original objective for SCE ApS when the conditions in Denmark became right with regards to exchange control and allowing investors to invest abroad.

Denmark did not allow investors to buy foreign shares and bonds and had, at the time, a strict exchange control. Therefore the company would operate as a bullion dealer in the meantime, with the sale of precious metals in bars and coins on margin and physical delivery over the counter to investors. In addition, the trading in various financial instruments, property bonds, Danish shares and Government Bonds.

The company undertook, according to a Royalty Agreement, to pay SCE ApS a minimum of one million kroner per month and more, according to its turnover, until all possible liabilities had been covered in the SCE ApS. This protected all the investors in SCE ApS and allowed the new company to make money. We asked the Danish National bank to pay up the capital of the company to D.Kr. 5M, this was refused and we only allowed to take one million to Denmark at the time.

We did not have any legal obligation to this in October 1979, we could simply let SCE Aps. go into liquidation or just stop trading with the company. Instead, I personally took on this liability as it was important for me to protect all the investors in SCE ApS; moreover, I predicted rightly that the new SCE A/S would make considerable profits and therefore pay any liabilities in the old company.

I.R. Financial Investment Limited

London, the I.R. stood for International Resources (see below). Trading in commodities and foreign exchange (Foreign exchange dealings for the Danish companies were not allowed in Denmark). This company allowed us to trade and hedge our currency requirement, but only in the last months prior to my arrest. Investment Exchange B.V. Rotterdam: trading in and sales of investment designed for international investors. The company had just started in late 1979.

International Resources B.V.

Rotterdam, Commodity Brokers dealing in coffee, cacao, sugar, soybeans, oil and metals in addition to trading in foreign exchange and various derivatives. At the time of my arrest, the company had more than US$300,000 in surplus sitting in a bank account. The company had many large Danish and Scandinavian companies as clients. This company was 100% owned by me via Capital Associates AG, however, shortly after my arrest it was stolen by Piet Boeck with the help from the Special Prosecution using false documentation.

International Resources was 100% owned by me via Capital Associates AG, however, shortly after my arrest it was stolen by Piet Boeck with the help from the Bagmandspolitiet (Special Prosecution) using false documentation. Piet Boeck assisted Bagmandspolitiet in every way initially, and his payment was to be allowed to steal the company, a company I had predicted to be the most profitable in the future. Piet Boeck’s father was a prominent lawyer in Copenhagen and may have assisted his son in this criminal deed. In addition, to the company, Piet Boeck stole a new luxury BMW and other valuables.

Nordisk Råvare Invest A/S Copenhagen

This company was 100% owned by me via Capital Associates AG, however, shortly after my arrest it was stolen by Piet Boeck with the help from the Special Prosecution using false documentation.

This company was just being established when SCE was closed. Bagmandspolitiet allowed the company to be stolen by Piet Boeck and Peter Engel Andreasen who were both employed by SCE (both in senior positions) when I was thrown into solitary confinement. They both were allowed to exploit the situation and my absence from the scene. Piet Boeck was able to steal cash and assets in excess of half a million dollars at the time. He was important for Bagmandspolitiet, as they did not initially want him in Denmark to assist me. His father was a respected lawyer and a deal was struck.

SCE Commodities ApS, Copenhagen

Established in 1977, as commodity broker and dealer. The company provided commodity hedging on the New York, Chicago and London commodity exchanges for various Danish and Scandinavian companies, including companies such as FDB, Aarhus Oliefabrik and the largest coffee importers in Scandinavia.

In addition to this, the company operated various educational seminars to teach companies how to hedge their liabilities with regards to commodity requirements. We even had seminars for the Finish company Nokia, which was a paper mill and cable company, using metals at the time. The company worked with the major Danish financial newspaper Børsen, and actively participated in the Børsen Seminars for several years where we saw during the years the attendance of many of the largest companies in Scandinavia.

ScanCapital A/S Copenhagen (1975)

An investment trust, one of the first in Scandinavia to invest and trade in commodities ranging from oil, copper, zinc, palladium, rhodium and silver to coffee and sugar. It was only possible at the time, due to exchange control, to act as a commodity dealer, trading both the physical and futures markets.

ScanCapital – (Skandinavisk Realinvestering og Handelsselskab A/S) The company purchased psychical commodities such as copper and zinc and kept these in warehouses in Rotterdam. In addition, the company traded on the futures markets at the London Metal Exchange, Chicago Board of Trade and New York Commodity Exchange. Among the initial investors were senior directors ØK (EAC, East Asiatic Company Ltd), at the time the largest company in Scandinavia with more than 40,000 employed.

It was also the aim of the company to invest in strategic metals such as Titanium, Zirconium, Chromium and Manganese when the markets become more transparent. This was the first investment trust of its kind in Scandinavia. (A New Commodity Boom) A company brochure from 1975 made for our investment trust

Scandinavian Mint A/S Copenhagen

Established in 1977, the sale of collectable and limited edition items, coins, cutlery and decorative art made in precious metals. Working with Spink & Son in London, the Royal Mint and World Wild Fund dealing in historic and collectables coin.

I believed that the collectors market would grow very large in time; moreover, that many people preferred paying crazy prices for collectables which in most cases had no value (look at the success of Franklin Mint at the time). Scandinavian Mint created Hans Christian Andersen’s Fairy tales Spoons in silver and gold and worked with Diners Club and American Express with the sale of this collection. We had plans in hand to make a series of Rodin figures of paperweights in precious metals and Scandinavian celebration coins.

We had negotiated with the British artist Henry Moore to make in gold and silver a series of hand-sized sculptures, for office desks. In fact, a hold series of plans were in hand at the time of my arrest.

Scandinavian Capital Exchange AB

Sweden, established in 1975. Operated with offices in Malmø and planned to open an office in Stockholm in March 1980, six weeks after my arrest. Advanced plans for the Stockholm office was in hand and with considerable expectations, as we looked at Sweden to be very potential as to our business and other financial products.

Scandinavian Capital Exchange A.S.

Norway, the company was awaiting permission to operate from the Norwegian National Bank; at the time Norway had very strict exchange and financial controls. We expected considerable profitability as to the financial markets in Norway, considering the large oil finds, moreover, we had many investors waiting to buy.

Scandevco Aps Copenhagen

(1976) Real estate agents and planned developer, initially, specialising in selling English cottages. Looking back it was very difficult to sell a cottage for £5,000 to Scandinavians which today 34 years later would be worth £750,000. The company had plans to enter into the sale of various holiday resorts in Scandinavia and Southern Europe taking advantage of the various fiscal opportunities to enter into the property market, including a large retirement development in the South of France.

Deferred Delivery Contract

Considering that Danish investors could not speculate on the foreign stock and commodity exchanges, in 1978 SCE developed a “margin” contract which allowed investors to buy precious metals without having to come up with all of the money. Also, allowing them to sell at any time and deduct the interest paid on the difference from the tax returns.

The contract was what it said, a deferred delivery contract, with the possibility to call for delivery some months or years in the future. In calling for a delivery the investor had to come up with another 70-90% of the investment. Since practically all investors did not have the other 70-90% of their investment, they, in reality, liquidated their contracts and had no interest in getting delivery.

The Deferred Delivery Contract could be said to protect SCE (the company) more than the investor, in fact, if the investors had read the small print (the terms of the contract, which later was used by the prosecution) they would have found that SCE had included many protections with regards to the company, including about setting the interest rates, delivery and price.

The investors had to accept SCE’s listed price when they sold back their contracts and if they selected to take delivery SCE could delay this delivery for months. So when the Danish press was writing about silver fraud up to a billion (milliard) and investors had purchased silver (for delivery), the press just wrote the manufactured lies from Bagmandspolitiet.

The truth: investors had paid a deposit of 10-30% of the total commitment in order to speculate on the price of silver, gold or platinum. If the price went up by 10-30% the investors would double their money, but if the price went down with the same amount they would have lost all of their deposit.

All investors buying SCE’s Deferred Delivery Contract (margin investment) during late December 1979 and the whole of January had made losses in excess of their deposit as of 31st January 1980, the day when Bagmandspolitiet closed the companies and arrested me. That day, SCE had made plans to make “margin calls” asking many clients to pay additional money to the company (up to 10 million Kroner) to keep their contracts valid; otherwise, SCE could just liquidate their contracts.

The standard conditions of SCE’s Deferred Delivery Contract had been approved by highly respected commercial lawyers in Denmark. Considerable executive time and money had been spent in order to have really secure business terms for the company, moreover, to satisfy any criticism from the National Bank and the fiscal authorities. The contract even included a paragraph to protect SCE from a situation that occurred when the authorities stormed and closed the companies.

A Special Force Majeure Clause

Protected the Company, even if the authorities should interfere in SCE business or make new laws, e.g. to close the trading in bullion etc. SCE had the right at all time to set all prices, including if the authorities interfered with the market or the companies. I had seen what had happened in many places when the government just abused their power and I, therefore, included this special force majeure clause in case of a non-fulfilment of contract due to the authorities.

As expected, Bagmandspolitiet – the Special Prosecution ignored also this part of the contract in order to make a case against me. The standard terms of this Deferred Delivery Contract allowed that if investors wanted delivery, they had to wait up to six weeks (thirty business days).

Because of the action by Bagmandspolitiet in Denmark, the Swedish Prosecution had to instigate a case in Sweden against my Swedish company: Scandinavian Capital Exchange AB.

In order to make a case, the Swedish Prosecution asked two respected law professors in Sweden to look at SCE’s Deferred Delivery Contract’s terms of condition. One of the law professors was the highly respected Professor Per Edwin Wallen from Lund’s University. The Swedish SCE contract was an exact copy of the Danish contract that SCE used in Denmark just translated into Swedish and approved by Swedish lawyers. Despite, that the Swedish prosecution wanted also to send a message to Swedes, as to speculate in precious metals, they were unable to find any criminal motive or act by the company or me.

The Swedish prosecution had already in June 1982 concluded, that there was no case to answer for the company and me as it’s managing director, I had not committed any criminal acts.

The two Swedish law professors concluded the following with regards to the standard conditions of SCE’s Deferred Delivery Contract with regards to the companies’ obligation to purchase precious metal:

“That such obligation did not exist and that MH (Mogens Hauschildt) as the companies Managing Director had acted in accordance with the contractual agreement entered into with the clients.”

In other words, I as the Managing Director did not have any obligation to buy or hedge our sale of silver, platinum, gold and other precious metals.

Nevertheless, the Danish authorities prosecuted me claiming that I had this obligation, moreover that it was a fraud – never mind the “Law”.

The Rigged Danish Justice System

Yes, the Danish justice system was rigged before my win and judgement against Denmark at the European Court of Human Rights in 1989.

Yes, it was rigged by political prosecutions like mine. Yes, it was rigged because the Ministry of Justice was in charge of the police, prosecution, the appointment of the judges, the courts and prisons.

Even the former Minister of Justice for seven years and longest-serving member of the Danish Parliament, Erik Ninn-Hansen confirmed that the judges in Denmark were not independent – but under the dictatorship of the Ministry - he should know!

Rigged definition in most dictionaries: - manipulated or controlled by deceptive or dishonest means

Rigged is defined as something that is fixed in a dishonest way to guarantee the desired outcome.